Cut Down the Time it

Takes for Taxes

Let’s find the right solution for your tax situation.

Our Mission is to Get the Maximum Refund for You for Less.

Our tax professionals are waiting online to help you with all of your tax needs. Most people who want help with their taxes have to go wait in line at “The Block,” and their cheapest service will run $180+. Instead, let our tax professionals take care of filing your taxes entirely online. We can get your taxes done with the return already processed in less than 2 hours

Pro Tips

We offer quick, easy to understandable bits of information that will help you improve your overall tax outcome. Check out our blog to learn more.

Maximum Refund Guarantee

We are so confident in our tax experts that we guarantee that we will help get your maximum tax refund. At the end of the day, you have earned it.

On Call 24/7

Tax Axe makes it easy to connect with and speak to our live agents who can help you navigate your tax situation. For contact information, see the bottom of this page.

Same Day Appointments

The Tax Axe now offers same-day appointments. With this tax season fast approaching, we understand the urgency of needing to file and speak to an expert.

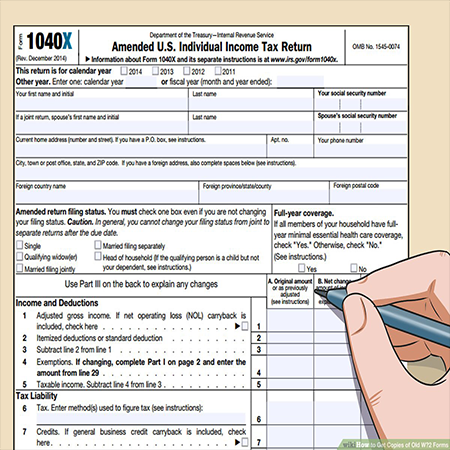

Easy E-file Importer

Switch over to Tax Axe from your previous online tax service by easily uploading a PDF of your previous year’s return. It’s just that simple.

Deduction Maximizer

Our CPAs and expert tax agents work together to uncover specific qualifying deductions and credits many filers don’t realize are available. This puts more money in your pockets.

Get the Guidance you Need from Start to Finish.

File Confidently with Tax Axe

Getting started is quick and easy. Our tax experts make getting the maximum refund you deserve simple and now for much less compared to the competitors. No matter your tax situation, we have the solution for you. Find out how Tax Axe can help you by checking out our solution list below.

W-2 Employee

Tax day is April 15, 2021. This is the deadline to file your federal income tax return. If you need help filing your income taxes, click the button below to learn more.

Home Owner

Homeowners can deduct interest expenses on up to $750,000 of mortgage debt from their income taxes. If you need help filing your income taxes, click the button below to learn more.

Business Owner

The law now provides a 20% deduction for those businesses. If you need help filling your companies business taxes, click below to learn more.

Dependents

Most taxpayers will take the standard deduction. As of 2021, the standard deduction is $12,550 for filing status single or married filing separately. Learn more about filing dependents here.

Retirement Income

Are you receiving an income and in retirement? Remember you will still need to file income tax. If you or a family member needs help with this, click the link below to learn more.

Student Loans

Want to find out how are expert tax team can help you get a tax deduction based on your student loan debt? Click the button below to learn how to get more money in your pocket.

Your Savings Starts Here

Flexible appointments and access to unlimited advice.

“5 Stars! I have been doing my own taxes for years. I’m also responsible for doing the majority of my own family member and some close friend’s taxes as well. I have tried out many different online tax software programs but Tax Axe is, by a long shot, the best in the business. It’s incredibly easy to use and very thorough.”

James Jackson

Tax Axe User (Greenville, NC)